How RBI Regulates financial Systems

The economy section of newspapers is overcharged by complex technical terms, which overwhelms articles. Therefore I am trying to explain the working of RBI with banking systems in simple language.

Nowadays, newspapers are overloaded with technical terms such as CRR, SLR, PLR, repo rate etc. These technical terms overwhelm the article; ultimately, neophytes like us cannot comprehend our monetary policies and their impact on our daily lives.

Therefore in this article, I am explaining different technical terms related to reserve bank and their policies in simple language along with their impact in a transparent uncomplicated language so that in future, most of the articles related to monetary policies will be a cakewalk for you.

How Commercial Banks and RBI work:

Commercial banks like Axis Bank, PNB and HDFC Bank, where we deposit our money, used to provide loans to the people with good credit scores and take some interest in the loan, and with this interest, the banks operate. But RBI applies some rules and regulations to control the cash flow and regulate these loans. Also, if these banks lack funds and have to return the money to their account holders, they can get short-term loans from RBI. If these banks give a mammoth amount of loans to the market with a low-interest rate, then it will result in very high cash flow in the market and increase the purchasing power of people; as a result, demands for the commodity will increase, which will increase the price and result in inflation. To control the inflation, therefore RBI regulates the loan by increasing the interest rate of loans it gives banks( repo rate) for the short term, or it takes a loan from the banks at some interest rate( Reverse repo rate), which reduces cash flow in the market and reduces inflation. However, if cash flow is deficient, it will depress the demands( of the commodity) and result in recession. High inflation and recession both are pathetic for the economy, so RBI keeps changing its rates frequently to balance the economy. Now you have a basic idea of the Banking system and reserve banks, so let’s discuss some technical terms.

Different Technical Terms :

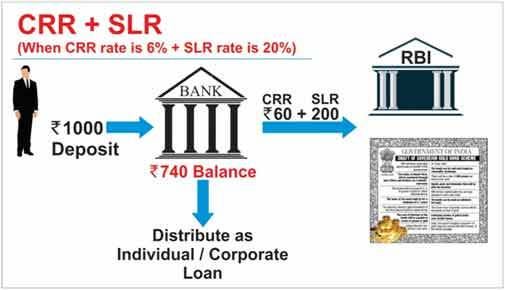

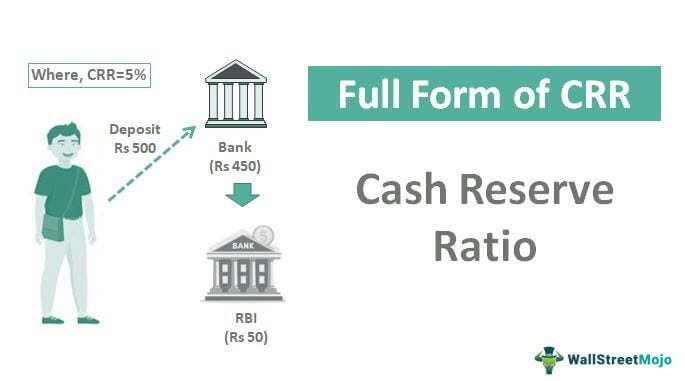

CRR( Cash Reserve Ratio): The fraction of cash banks have to deposit in the RBI as a reserve amount, without any interest. This varies between 4-5%.

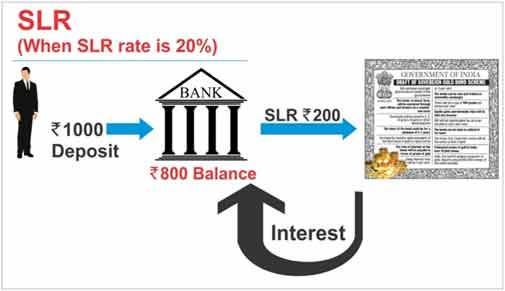

SLR( Statutory Liquid Ratio): Certain fraction of the total amount banks have must be kept in the form of any liquid asset( cash, gold or govt. bond). Although these banks keep this cash to themselves, they can’t use this for providing loans. This varies from 20%- to 25%.

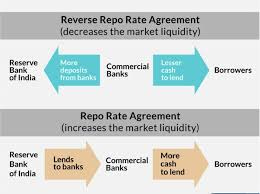

Repo Rate: Repo rate or reputation rate is the interest rate at which RBI give short loans to the banks. If the repo rate is low, then banks offer loans to their customer at a low-interest rate; however, it increases the liquidity in the market and inflation increases. Increment in repo rate reduces inflation, but banks offer loans at higher interest rates; consequently, our EMIs increases.

Reverse Repo Rate: To control the excess cash flow in the market, RBI takes loans from the banks, and the interest rate at which RBI takes the loan is called the reverse repo rate. If reverse repo rates are higher, then for banks to give loans to RBI is safe and secure than providing loans to any other person because RBI will not betray the banks by doing any exasperating work like Vijay Mallya, So banks prefer to give loans to RBI as result cash flow in the market reduces.

I hope this article was informative for you; if you got any insightful information, please like my writing and to receive these kinds of articles in your inbox, please subscribe to my newsletter.

By dropping genuine feedback in the comment section, please help me to improve.